how to report coinbase on taxes

Its the form used for crypto exchanges because it doesnt simply detail profits it lists the. Coinbase 1099 Form 1099 reports your third-party transactions to the IRS.

Coinbase Makes It Easier To Report Cryptocurrency Taxes In 2022 Cryptocurrency Fiat Money Tax Software

Coinbase 21 Comments Top Add a Comment bitcointaxes 5 yr.

. Log in to your Coinbase Pro account and select your profile in the top right then statements. Yes youll need to report your cryptocurrency capital gains and losses on your taxes because even if you do not Coinbase does report your crypto activity to the IRS if you. You may be able.

Enter the total short term on one line and total long term on the next line. How to generate a Coinbase Wallet tax report. Next select privacy and find the request data export button.

Within CoinLedger click the Add Account. Tax reports used to work but now show no gainslosses at all. They do not report anything relating to capital gains since.

On the statements page you can generate both an accounts statement and a fills. How to do your Coinbase Pro taxes. Select the relevant cryptocurrency.

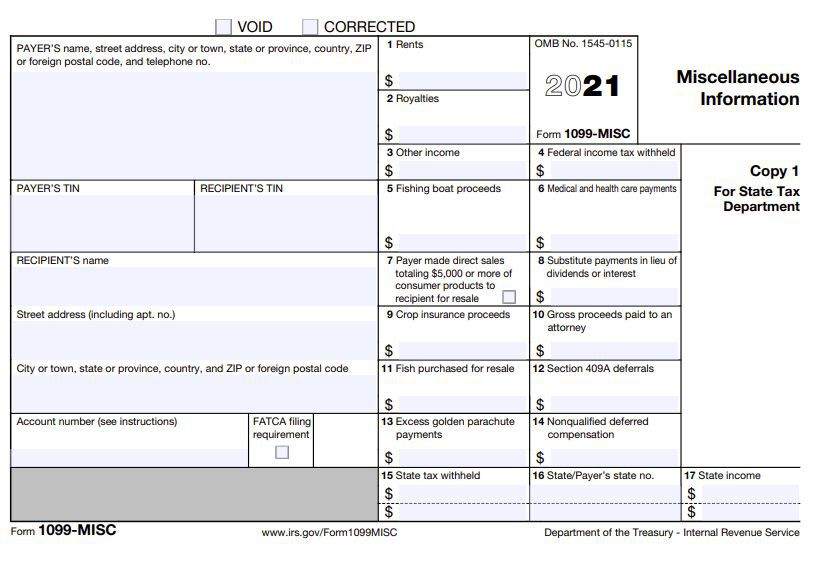

If you earn 600 or more in a year paid by an exchange including Coinbase the exchange is required to report these payments to the IRS as other income via IRS Form 1099-MISC. Very easy and the program gives you the instructions. Log in to your Coinbase account and click on your profile icon in the top right corner then go to settings.

If you made 600 in crypto Coinbase is required to use Form 1099-MISC to report your transactions to the IRS as miscellaneous income Even if you make less than 600 via. Coinbase GainLoss Report This tax season Coinbase customers will be able to generate a GainLoss Report that details capital gains or losses using a HIFO highest in first out cost. Ago They send 1099-K if you are merchant and accept payments.

Paste your xPub address or public address. Calculate and prepare your Coinbase taxes in under 20 minutes. How to Report Your Coinbase.

Join our Cryptocurrency Newsletter for tutorials and cutting Edge topicshttpschicvoyageckpagec5218e0a60You may need to download your transactions for. You can use this as a tool to actually report taxes OR just simply see how. When required by the IRS the crypto exchange or broker you use including Coinbase has to report certain types of activity directly to the IRS using specific forms and provide you with a.

While you could generate a tax report yourself it can be a very complicated process. Go to the trade. Upload a CSV file to Coinpanda Log in to your account on Coinbase Wallet.

Heres how you can include all of your Coinbase Pro transactions on your tax report within minutes. A few years ago in 2017 and 2018 for example I was able to download tax reports from Coinbase and they had all the. Mail in a copy of your 1099-B.

Import trades automatically and download all tax forms documents for Coinbase easily. Wherever you live your tax office wants to know about all.

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Crypto Tax And Accounting Software Libra Raises 15m In Series B Funding Planejamento De Negocios Negocios Cometer Erros

Do Crypto To Crypto Transactions Have Tax Implications Taxbit

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

How Is Cryptocurrency Taxed Forbes Advisor

Gold Nuggets Dog Food Recipes Vitamin C Tablets Food

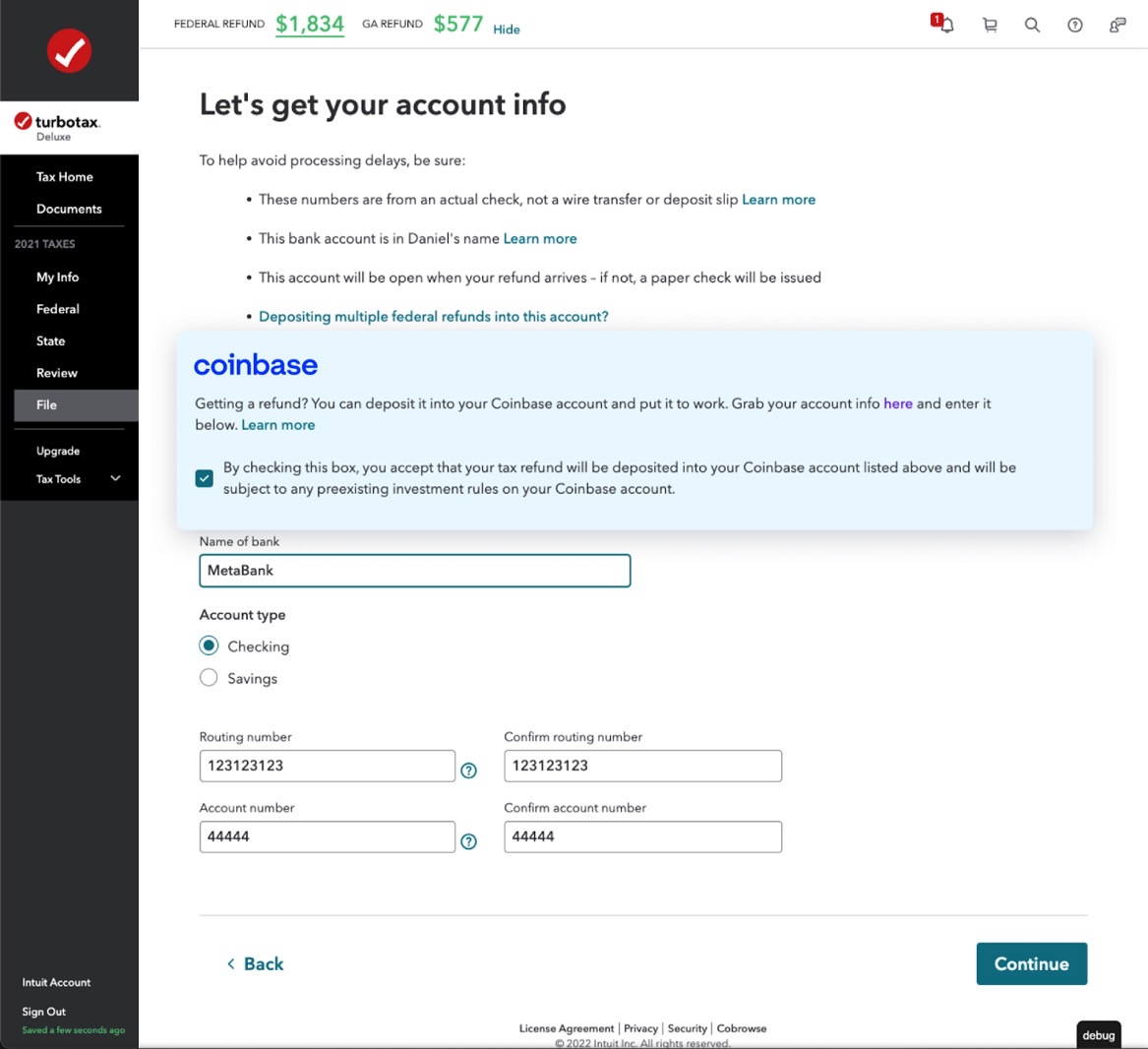

Coinbase Lets You Receive Your Tax Refund As Cryptocurrency Bgr

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Reflections On Bitcoin Transaction Batching Bitcoin Transaction Bitcoin Reflection

Top 7 Best Crypto Tax Software Companies

Does Coinbase Report To The Irs Tokentax

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Nigerian Currency Recovers Versus Us Dollar Central Bank Says Importers Must Repatriate Forex In 2022 Forex Us Dollars Central Bank

![]()

Cointracker Partners With Coinbase To Offer Crypto Tax Solutions Cointracker

Coinbase Taxes Explained In 3 Easy Steps Youtube

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

Us Postal Inspectors Need Comprehensive Crypto Training Audit Finds Irs Tax Payment Cryptocurrency